Irs Schedule C Instructions 2024 – Taxpayers could have started filing their taxes for the 2023 tax year on Jan. 29.. You can use the schedule chart below to estimate when you can expect to receive your refund based on when you . You must have some Schedule C income from self-employment to be eligible for the Those calculations are complicated, but the instructions to IRS Form 8829can help. For a list of eligible expenses, .

Irs Schedule C Instructions 2024

Source : www.irs.govHarbor Financial Announces IRS Tax Form 1040 Schedule C

Source : www.kxan.com2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable

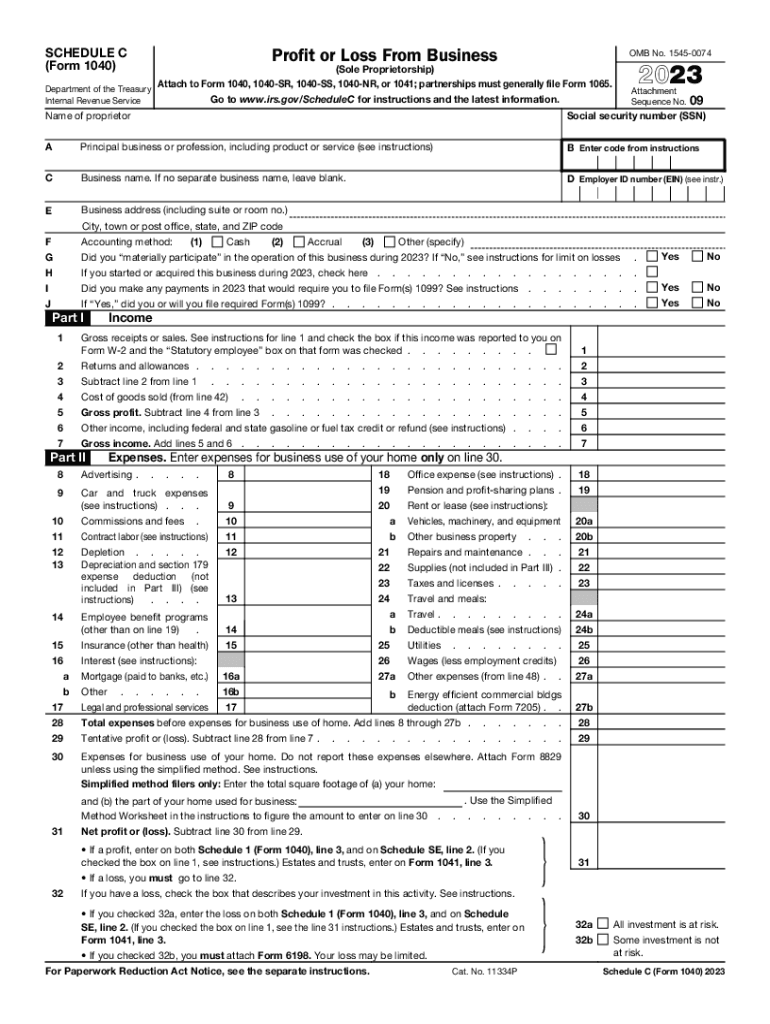

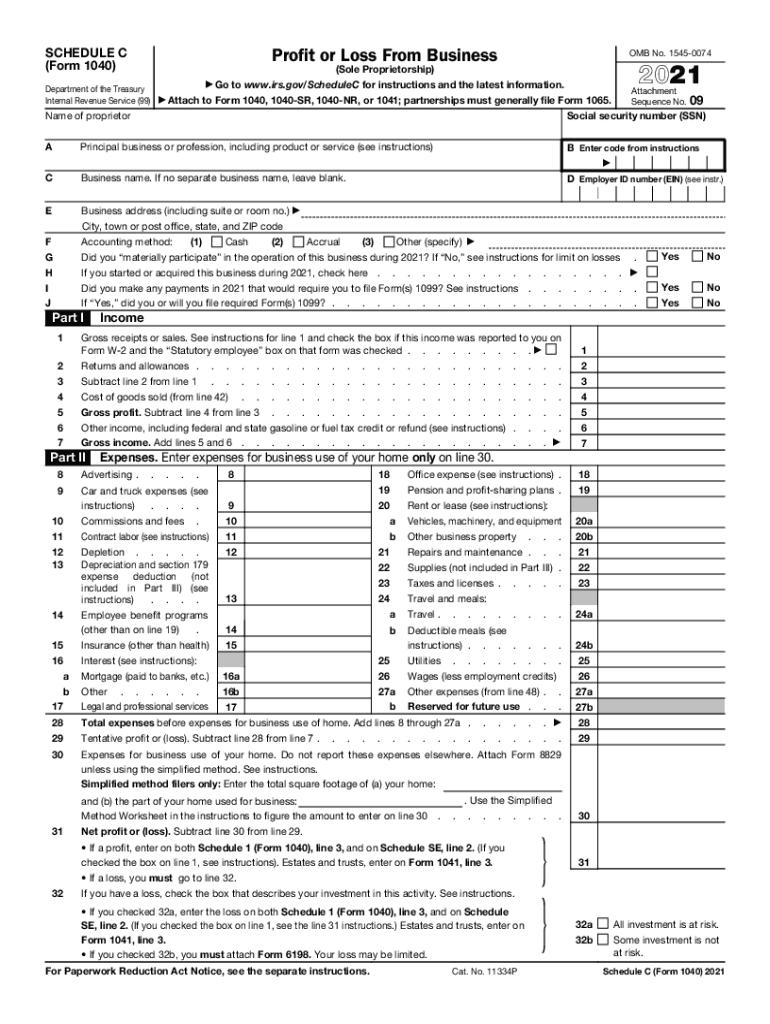

Source : irs-schedule-c-ez.pdffiller.comSchedule C (Form 1040) 2023 Instructions

Source : lili.co2023 Form IRS 1040 Schedule C Fill Online, Printable, Fillable

Source : 1040-schedule-c.pdffiller.comWhat Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.com2023 Form IRS Instructions 1040 Schedule C Fill Online, Printable

Source : instruction-schedule-c.pdffiller.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov1040 schedule c: Fill out & sign online | DocHub

Source : www.dochub.comWhat is an IRS Schedule C Form?

Source : falconexpenses.comIrs Schedule C Instructions 2024 2023 Instructions for Schedule C: The Internal Revenue Service (IRS) has unveiled its annual inflation adjustments for the 2024 tax year, featuring a slight uptick in income thresholds for each bracket compared to 2023. . Made money from theft, bribery, or illegally selling drugs last year? You should report it on your taxes, the IRS says. .

]]>